Beneficiaries cannot demand a share of the trust property held in the Discretionary trust. Policies remain in the Discretionary trust until an appointment is made.

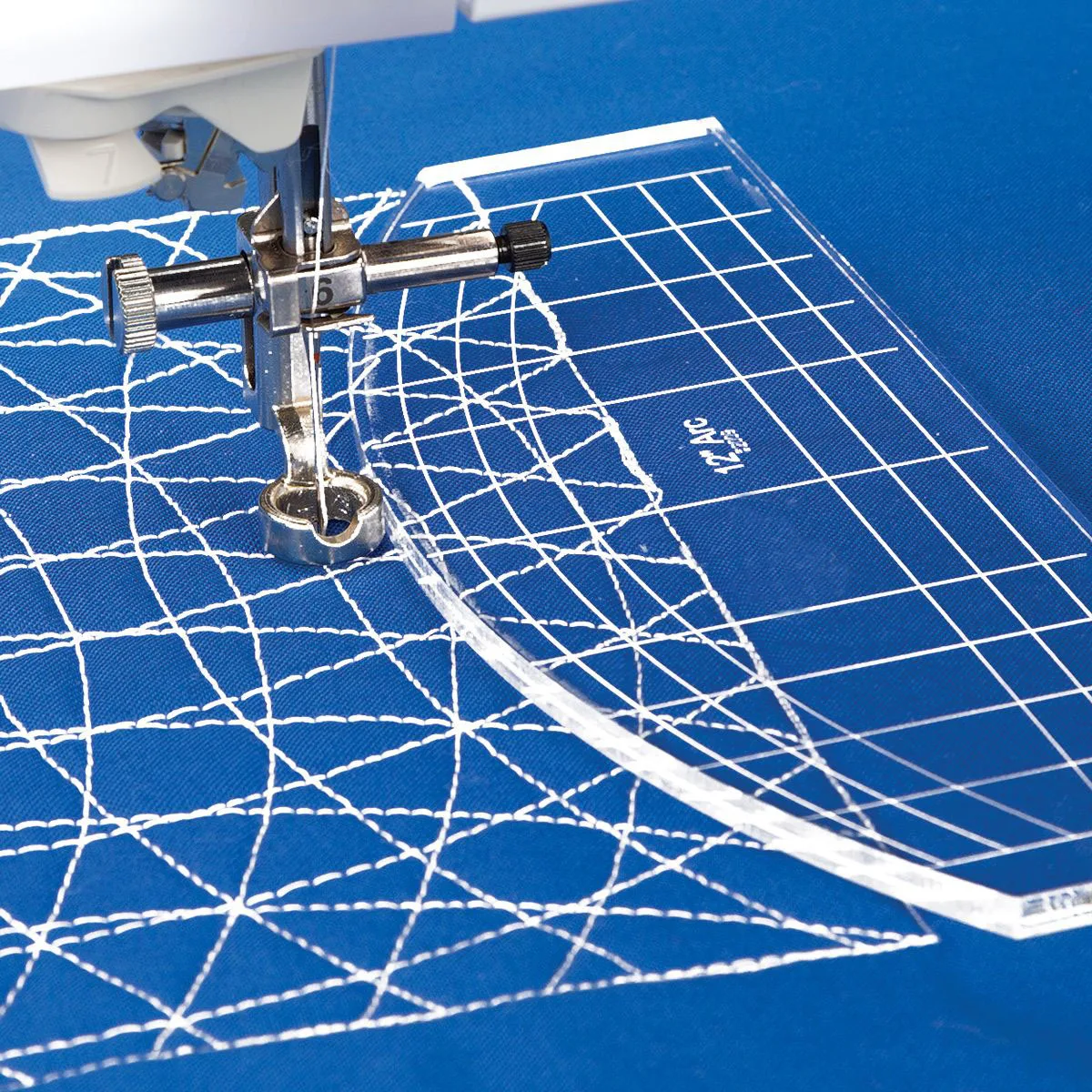

#Best quilting rulers how to#

Kim from Chatterbox Quilts explains how to use these markings to create accurate spacing between quilted lines when quilting on your domestic sewing machine. The trustees can appoint as many policies as they need at the time. There can be lots of markings on a ruler template - which is a good thing - but they can also be confusing.When the trustees encash these policies, the tax assessment is based on the tax position of the beneficiary and not the trustees or settlor (unless the beneficiary is the minor, unmarried child of the settlor). When the trustees wish to make a distribution to a beneficiary, use the ‘Best Start in Life deed of appointment’ to move individual policies within the bond from the Discretionary trust to a bare trust for a beneficiary.The trustees use their discretion to decide who may benefit from the trust and when. CRAFTERS WORKSHOP TrueCut Non-Slip Ruler Grips If you have been using quilting rulers without any ruler racks or non-slip grips, you know how much of a hassle it is.Beneficiaries not covered by the classes can be added to the trust by the settlor. Classes of beneficiary are defined within the deed for example, ‘children and decedents of the settlor’.They can also appoint themselves as a trustee. This is a trust where your client, the settlor, cannot be included as a beneficiary.It combines with it some of the best aspects of an Absolute trust (also known as a Bare trust).

The Best Start in Life trust is a planning solution using the Discretionary trust - settlor excluded.

0 kommentar(er)

0 kommentar(er)